You paid for the system, which cost $2,000, in cash. Apart from having the data for your transaction on hand, you'll need to decide which accounts that will be debited and credited.įor example, imagine that you’ve just purchased a new point-of-sale system for your retail business.

You’ve created your set of financial accounts and picked a bookkeeping system-now it’s time to record what’s actually happening with your money.

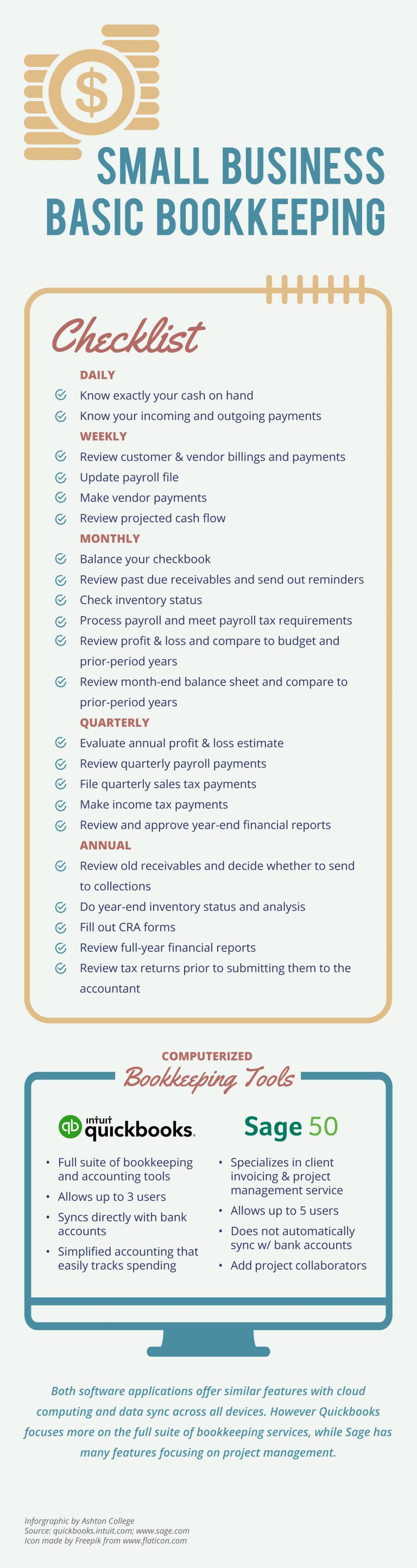

#BOOKKEEPING BASICS SOFTWARE#

However, general ledgers can get complicated if you're trying to juggle multiple accounts.īookkeeping software (which can cost anywhere from nothing to several hundred dollars a month, usually depending on your business's size and needs) automatically generates a general ledger for you and populates it with accounts.Īlternatively, you can pay an accountant, bookkeeper, or outsourced accounting company to manage your accounts and ledger for you.

Using a spreadsheet is the cheapest option, especially if you use Google Sheets rather than Microsoft Excel, which costs a monthly fee. There are a few main ways to set up a general ledger. Recording a financial transaction in your general ledger is referred to as making a journal entry. Now, general ledgers are mostly virtual-instead of jotting down transactions on a piece of parchment with a quill and ink, business owners enter and organize transactions with a spreadsheet or with bookkeeping and accounting software.Įvery time you perform a financial transaction-for instance, make a sale, accept a client's invoice, or pay a bill-you should record that transaction in your general ledger.

#BOOKKEEPING BASICS HOW TO#

We'll show you examples of how to record a transaction as both a credit and debit later on.Ĭenturies ago, businesses would record their financial transactions in a physical book called the general ledger (GL). If you choose to used double-entry bookkeeping-and we strongly suggest you do!-you'll record each transaction as a credit and as a debit. (One notable exception is FreshBooks's cheapest plan, which offers single-entry only-which, frankly, we don't love.) Plus, nearly all bookkeeping and accounting software use double-entry accounting anyway. No matter how much money you bring in a month, we generally recommend double-entry accounting as a better choice for most small-business owners. Since you make two entries per transaction, you're better equipped to catch small mistakes in your record before they turn into major financial problems. This method can work for freelancers or sole proprietors with no more than one or two business transactions a month.īut single-entry bookkeeping is less accurate than double-entry, which has you record each transaction twice: once as a debit and once as a credit. It requires you to record each financial transaction just once in your overall bookkeeping record. Single-entry bookkeeping is the simpler bookkeeping choice. You'll need to choose a method before you can start keeping your financial record, since the method you choose determines how and where you record each financial transaction. There are two main bookkeeping methods: single-entry and double-entry. A financial expert can give individualized bookkeeping advice specific to your unique business while providing a more in-depth look at the basic principles we cover here. Along with reading this page to get a quick bookkeeping overview, we always recommend meeting with a CPA (certified public accountant) or bookkeeper long before you open your doors-or, if you've already launched your business, as soon as possible. But whether you plan to do bookkeeping yourself or outsource it to an accountant, it pays to understand the basics of bookkeeping.īelow, we'll break bookkeeping down to its most basic principles.

#BOOKKEEPING BASICS UPDATE#

( Free bookkeeping software can help you save money if you're just starting out.) Alternatively, in-house or outsourced bookkeepers can update your books for you, typically for a monthly fee. Fortunately, most small-business bookkeeping software was made specifically for non-accountant small-business owners. If you've never worked in finance before, small-business bookkeeping can feel overwhelming. It's foundational to running a profitable business-after all, if you don't know how much you're making or where that money is going, you'll have a hard time finding ways to expand your profitability. Bookkeeping is the process of recording your business's financial transactions so that you know exactly how much you're making and where your money is going.

0 kommentar(er)

0 kommentar(er)